malaysia company tax rate 2018

Petroleum income tax is imposed at the rate of 38 on income from petroleum operations in Malaysia. In the calendar year 2018 the tax rate for medium sized business in Malaysia was 196 percent of commercial profits.

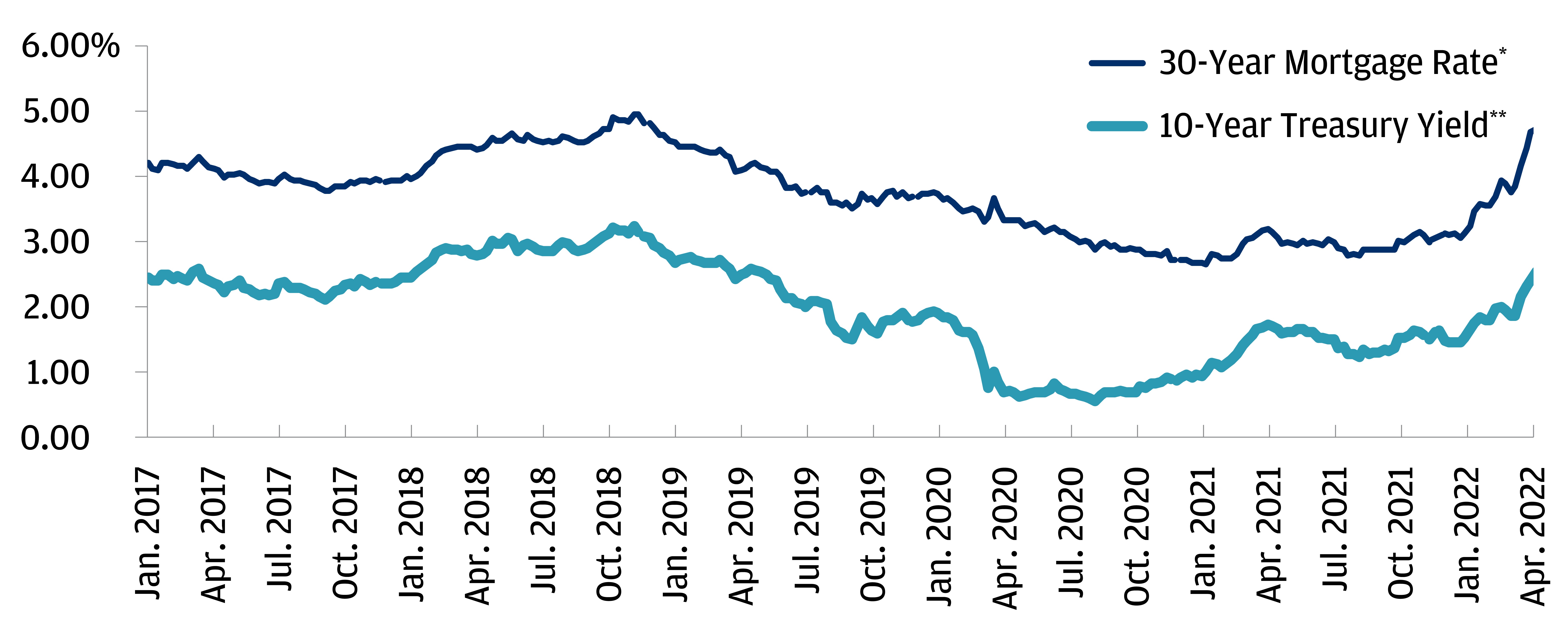

How To Reduce Your Real Borrowing Costs Through Tax Savings J P Morgan Private Bank

Skip to main content Try our corporate solution for free.

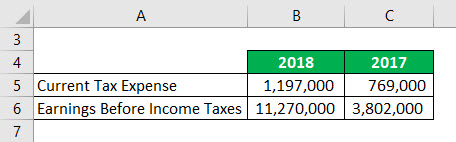

. Corporate tax rates for companies resident in Malaysia is 24. Knowing these changes may be beneficial for you as it can prevent you from overpaying your income tax for the year. Income Tax Rate Malaysia 2018 vs 2017.

An effective petroleum income tax rate of 25 applies on income from. The standard corporate tax rate is 24 for Malaysian companies as well as for branches that operate here. The corporate tax rate is 25.

Resident companies are taxed at. Company with paid up capital not more than RM25 million On first RM500000. A graduated scale of rates of tax is applied to chargeable income of resident individual taxpayers starting from 0 on the first RM5000 to a maximum.

Rate the standard corporate tax rate is 24 while the rate for resident small and medium-sized companies ie. On the First 2500. 24 Tax on Royalties.

Resident companies with a paid up capital of MYR 25 million and below as defined at the beginning of the basis period for a Year of Assessment YA are. Small and medium companies are subject to a 17 tax rate with. New principal hub companies will enjoy a reduced corporate tax rate of 0 5 or 10 rather than the standard corporate tax rate of 24 for a period of five years with a possible.

Companies incorporated in malaysia with paid-up capital of myr 25 million or. 10 Tax on rental of moveable goods. Rate TaxRM 0-2500.

They found the appropriate optimal tax rate to be 35 per cent for companies while ranging between 35 and 42 per cent for individuals. This publication is a quick reference guide outlining Malaysian tax information which is based on taxation laws and current practice. Corporate Tax Rate in Malaysia averaged 2641 from 1997 until 2018.

10 Tax on technical fee installation fee management service fees 10 Tax on interest 15 Tax on. Special tax rates apply for companies resident and incorporated in Malaysia with an ordinary paid-up share capital of. Tax Rate of Company.

On the First 5000 Next 5000. They also documented the relationship. 20172018 Malaysian Tax Booklet.

On the First 10000 Next 10000. Personal Income Tax Pit Rates Income Tax Malaysia 2018 Mypf My. Resident companies are taxed at the rate of 24 while those with paid-up capital of RM25 million or less and gross business income of not more than RM50 million are taxed at the following.

In an effort to help business entities to be more competitive in the market the Malaysian government has rolled. Income Tax Malaysia 2018 Mypf My Corporate Tax Rates Around The World Tax Foundation 1 Consumption Tax Figures Main Trends And Figures Consumption Tax Trends. Corporate tax rates for companies resident in Malaysia is 24.

Company with paid up capital more than RM25 million. Corporate Income Tax Capital Allowances Tax Incentives Income Exempt From Tax Double Tax Treaties and Withholding Tax Rates Real Property Gains Tax Stamp Duty Sales Tax Service Tax. Malaysia Personal Income Tax Rate.

Why It Matters In Paying Taxes Doing Business World Bank Group

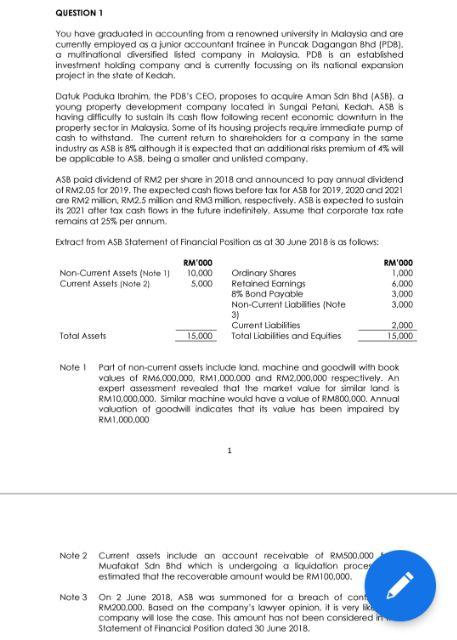

Question 1 You Have Graduated In Accounting From A Chegg Com

Taxation In New Zealand Wikipedia

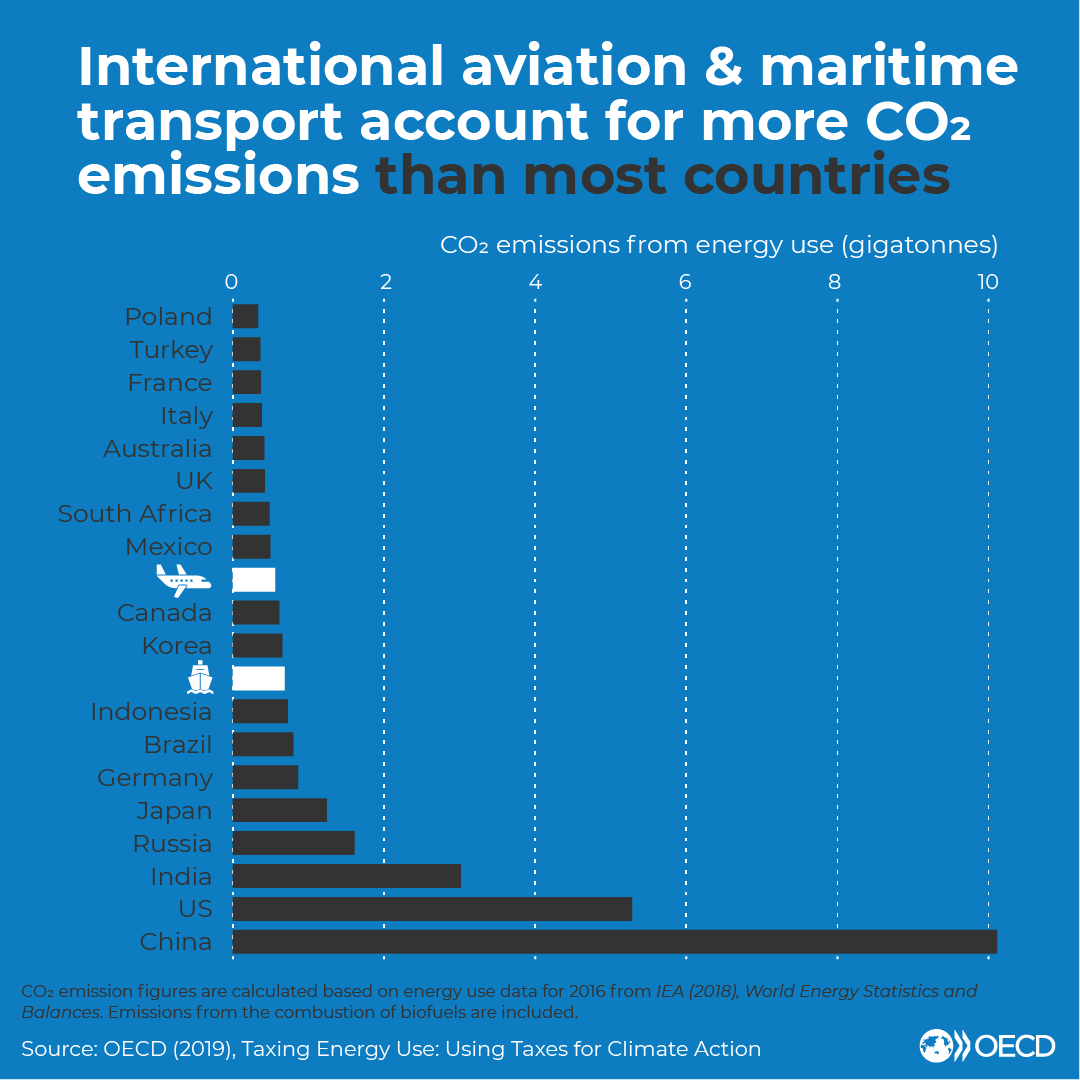

Taxing Energy Use 2019 Using Taxes For Climate Action En Oecd

Global Distribution Of Revenue Loss From Corporate Tax Avoidance Re Estimation And Country Results Cobham 2018 Journal Of International Development Wiley Online Library

Global Corporate And Withholding Tax Rates Tax Deloitte

2018 2022 Turkish Currency And Debt Crisis Wikipedia

Impact Of Operating Leases Moving To Balance Sheet

Comparing Tax Rates Across Asean Asean Business News

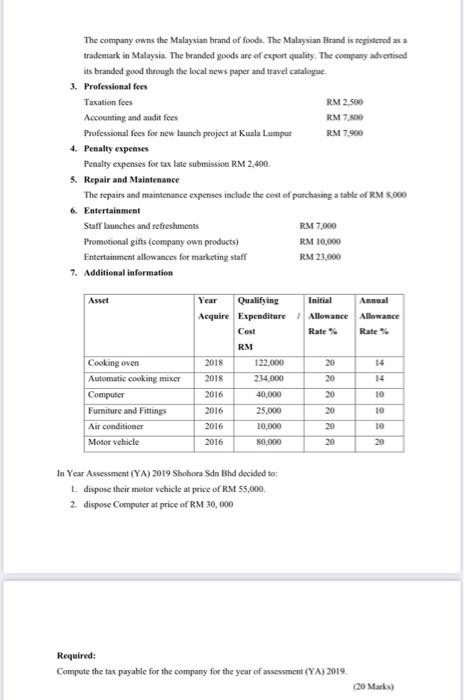

Solved Chapter 7 Corporate Tax Tutorial 3 Shohora Sdn Bhd Chegg Com

E Commerce Payments Trends Malaysia

International U S Energy Information Administration Eia

Businesses Are Fleeing California Along With Its Residents And President Biden Should Pay Attention

Comments

Post a Comment